Table Of Contents

- Understanding the Foundation: Why Personalized Marketing Matters in Fintech

- The Power of Uplift Models in Monzo's Arsenal

- Building and Training Product-Specific Uplift Models

- Multi-Objective Optimization: Balancing Multiple Campaigns

- Testing the Waters: Controlled Experiments for Real Impact

- Integrating Marketing Customization in Digital Banks

- Best Practices and Tools for Fintech Marketing Optimization

- FAQs

- Conclusion: The Future of Data-Driven Fintech Marketing

In the fast-paced world of fintech, where users expect seamless, tailored experiences, standing out means getting personal. Imagine logging into your banking app and seeing a message that feels like it was crafted just for you—maybe a nudge to open a savings pot when you’re eyeing that dream vacation, or an invite to premium features that align with your spending habits. That’s the magic Monzo has mastered through its innovative approach to Monzo personalized marketing optimization. As a digital bank that’s grown from a startup to a household name in the UK, Monzo isn’t just sending messages; it’s building relationships that drive real value.

Drawing from their data team’s insights, Monzo has transformed how they communicate with millions of users. By leveraging uplift models and smart optimization algorithms, they’ve increased campaign effectiveness by as much as 200% compared to blanket targeting. This isn’t about bombarding inboxes—it’s about precision, respect for user experience, and delivering the right message at the right time. Let’s dive into how Monzo does it, why it works, and what other fintechs can learn to elevate their own strategies.

Understanding the Foundation: Why Personalized Marketing Matters in Fintech

Picture this: You’re a busy professional juggling bills, savings, and investments. Generic emails about “great new features” get ignored, but a targeted suggestion based on your recent transactions? That grabs attention. In fintech, where competition is fierce from players like Revolut and Starling, Monzo marketing message strategy focuses on relevance to cut through the noise.

Statistics back this up. According to a 2023 McKinsey report, personalized marketing can boost customer engagement by 20-30% in financial services. For digital banks, where user retention hinges on trust and utility, optimizing fintech marketing communication isn’t optional—it’s essential. Monzo’s approach ensures messages align with internal principles, limiting frequency to prevent overload while maximizing impact.

At its core, this strategy revolves around data-driven messaging Monzo style: using customer behaviors, preferences, and past interactions to predict what resonates. It’s not guesswork; it’s science. By analyzing transaction data, app usage, and response history, Monzo creates a feedback loop that refines every campaign.

The Power of Uplift Models in Monzo's Arsenal

Ever wondered how Monzo decides who gets which message? Enter uplift models—a game-changer in predicting user responses. These models estimate the “uplift” or additional value from sending a message versus doing nothing. For instance, they might forecast how much extra a user saves after a targeted prompt.

Monzo’s data team, as shared in their insights, categorizes users into four types:

- Treatment Only: These folks respond positively only when nudged—like opening a savings pot after a reminder.

- Adverse Effect: Contacting them backfires, leading to disengagement.

- Sure Things: They’ll act regardless, so no need to waste a message slot.

- Never: Unlikely to respond, ever.

To build these models, Monzo runs randomized A/B tests, splitting users into treatment (messaged) and control (not) groups. This data trains models using libraries like CausalML. They employ two main types:

- T Meta-Model: Separate models for treatment and control groups, then subtract predictions for uplift.

- S Meta-Model: One model incorporating a treatment indicator variable.

While the T model risks overfitting, and the S might overlook weak effects, Monzo mitigates this through feature selection and internal data like user demographics and behaviors. The result? Predictions of additional product value, whether it’s binary (e.g., subscribing to Monzo Plus) or continuous (e.g., savings amount).

In practice, this means Monzo can forecast that sending a message to a “Treatment Only” user might add £50 to their savings, while for an “Adverse Effect” user, it could reduce engagement. This precision in user segmentation Monzo campaigns ensures resources target high-potential individuals, boosting ROI.

Building and Training Product-Specific Uplift Models

Monzo doesn’t apply a one-size-fits-all model. Each product—like savings pots or premium subscriptions—gets its own uplift model, trained on historical A/B test data from past campaigns.

The process starts with compiling datasets: All eligible users, their responses, and predictive features (e.g., transaction history, app engagement). Feature selection prunes irrelevant data to avoid overfitting, ensuring models stay accurate.

Targets vary by product. For savings, it’s the additional amount deposited; for subscriptions, it’s uptake rate. By predicting uplift, Monzo quantifies the value of each message, turning marketing into a measurable science.

Trends show this is catching on. A 2024 Gartner study predicts 80% of fintechs will adopt AI-driven predictive models by 2026, up from 40% today. Monzo’s early adoption gives them an edge, but it’s replicable. Tip: Start small—pilot with one product, measure uplift, and scale.

Multi-Objective Optimization: Balancing Multiple Campaigns

Here’s where it gets sophisticated. Monzo promotes multiple products, each with unique goals. Enter multi-objective optimization: Maximizing overall value while respecting constraints like message limits.

The algorithm uses uplift predictions to assign users to the most fitting campaign. For two products (A and B), a parameter “t” determines priority—if Product A’s uplift is t times greater than B’s, assign to A.

Simulation is key. Monzo tests various t values, plotting trade-offs: Higher t favors one product, potentially hitting reach goals for both. They select t that boosts additional value and meets team objectives.nubank.com

Case in point: In simulations, adjusting t increased uplift across campaigns without overwhelming users. This data-driven messaging Monzo approach ensures equitable promotion, aligning with business needs.

For fintechs, this means thinking beyond single campaigns. Example: A neobank promoting loans and investments could use similar logic to prioritize based on user credit scores and portfolio data, optimizing for conversion rates.

Testing the Waters: Controlled Experiments for Real Impact

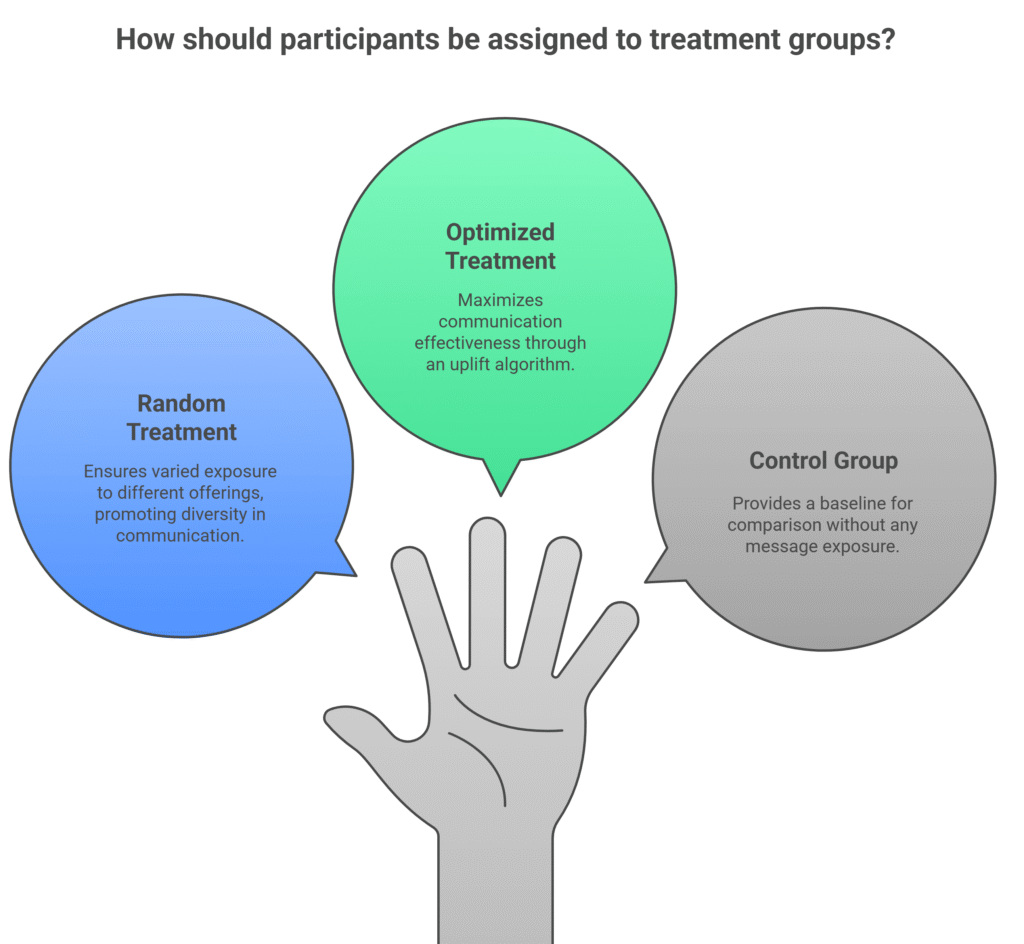

No strategy is complete without validation. Monzo runs A/B tests comparing optimized vs. random assignment:

- Random Treatment: Users randomly get a product message.

- Optimized Treatment: Assigned via uplift algorithm.

- Control: No message.

This measures true uplift—optimized often shows 200% relative gains in smaller campaigns, where targeting precision shines. Larger ones see absolute boosts from broader reach.

Post-experiment, data refreshes models, countering drift as user behaviors evolve. Industry pattern: Fintechs like Chime report 15-25% engagement lifts from similar testing, per a 2025 Forrester analysis.

Practical tip: Always include a control group. It baselines “do nothing” scenarios, revealing if messages add value or just annoy.

Integrating Marketing Customization in Digital Banks

Monzo’s success highlights marketing customization digital banks can achieve. By automating personalized messages Monzo-way, they blend human insight with AI efficiency.

Fintech user engagement tactics like this rely on clean data pipelines and ethical handling—Monzo emphasizes privacy, complying with GDPR. Tools? Beyond CausalML, platforms like Google Analytics or Amplitude track behaviors.

AB testing banking promotions is foundational. Monzo’s randomized splits ensure unbiased data, feeding into models for continuous improvement.

Story time: A user frustrated with generic ads switched to Monzo after a spot-on savings tip. That’s the emotional win—building loyalty through relevance.

Best practices for fintech marketing optimization: Focus on uplift modeling, simulation, and ethical data use for sustained gains.

Customer segmentation strategies in digital banks: Categorize by response types, prioritize high-uplift users.

Tools for automating personalized banking messages: CausalML for modeling, Braze for delivery.

Measuring customer engagement in fintech campaigns: Use uplift scores, conversion rates, and feedback loops.

Best Practices and Tools for Fintech Marketing Optimization

Ready to implement? Here are actionable steps:

- Audit Your Data: Ensure access to behavioral, transactional, and demographic info.

- Choose Models Wisely: Start with S meta-models for simplicity, graduate to T for nuance.

- Simulate Extensively: Test parameters to balance objectives.

- Measure Holistically: Track uplift, engagement, and churn.

- Scale Ethically: Prioritize user consent and transparency.

Tools for automating personalized banking messages include:

- AI-driven personalization software for banking like Adobe Experience Cloud.

- Campaign optimization tools for fintech marketing such as Braze or Iterable.

- Solutions for automated user segmentation in banking apps like Segment.

- Customer analytics platforms for digital banks including Mixpanel.

Current trends: With AI advancements, expect hyper-personalization via real-time data. A 2025 Deloitte report forecasts 50% growth in fintech ad spend on personalized channels.

Case Study: Monzo’s 200% uplift isn’t isolated—Nubank in Brazil saw similar gains post-uplift adoption, per their 2024 earnings.partner2b.com

What is the approach to personalized marketing messages at Monzo?

Monzo uses uplift models to predict user responses, optimizing assignments for maximum value while limiting message frequency.

What makes Monzo’s customer engagement effective?

It’s the blend of data-driven targeting, user segmentation Monzo campaigns, and ethical constraints that prevents overload and boosts relevance.

What are the benefits of marketing segmentation for fintechs?

Higher engagement (up to 30% per McKinsey), better ROI, and reduced churn through tailored experiences.

How does Monzo optimize its marketing messages for different users?

Via uplift predictions and multi-objective algorithms that assign the best campaign per user.

How can fintech companies personalize communication efficiently?

Adopt uplift modeling, run A/B tests, and use automation tools for scalable targeting.

Can data science improve customer marketing in fintech?

Absolutely—Monzo’s 200% uplift proves it enhances precision and outcomes.

Should banks automate their personalized marketing efforts?

Yes, for efficiency and scale, as seen in automating personalized messages Monzo employs.

Are A/B tests important for optimizing banking messages?

Essential—they provide the data foundation for models and validate optimizations.

FAQs

Conclusion :The Future of Data-Driven Fintech Marketing

Monzo personalized marketing optimization isn’t just a tactic—it’s a philosophy that puts users first. By harnessing uplift models, smart segmentation, and rigorous testing, they’ve set a benchmark for fintech user engagement tactics. Whether you’re a marketer at a startup or a established bank, these insights offer a roadmap to more meaningful connections.

As fintech evolves, expect more integration of AI and real-time data. Monzo’s story shows that when you optimize with empathy and evidence, everyone wins—users get value, and businesses thrive. What’s your next step? Dive into your data, experiment boldly, and watch engagement soar.CareerSwami