The Indian food delivery market has witnessed significant growth and transformation over the past few years, largely driven by the two leading players, Zomato and Swiggy. As of 2024, these two companies have dominated the landscape, engaging in a fierce battle for market leadership. 💥

This blog delves deep into the performance of Zomato Vs. Swiggy from 2022 through mid-2024, analyzing their growth trajectories, market dynamics, key challenges, and what the future might hold for these food delivery giants. 🍽️

The Indian Food Delivery Market: An Overview

The Indian food delivery market has rapidly evolved, becoming one of the most competitive and lucrative sectors in the country. Valued at over $5 billion in 2023, the sector has shown robust growth, driven by increasing internet penetration, a growing middle class, and changing consumer behavior towards convenience and online services.

Zomato and Swiggy have been at the forefront, capturing significant market share and reshaping how Indians consume food.

Key Drivers of Market Growth

- 🌐 Digital Penetration: With over 900 million internet users in India, the digital revolution has been a crucial driver for the growth of the online food delivery market.

- 🏙️ Urbanization: The increasing urban population, especially in Tier 1 and Tier 2 cities, has fueled demand for online food delivery services.

- 📲 Changing Lifestyles: Busy work schedules, a growing trend of nuclear families, and the desire for convenience have led to a shift in how people view dining, with a marked preference for online food ordering.

- 💰 Investment and Innovation: Both Zomato and Swiggy have attracted significant investments, enabling them to innovate, expand their services, and subsidize discounts, further driving consumer adoption.

Zomato vs. Swiggy: Performance Overview (2022-2024)

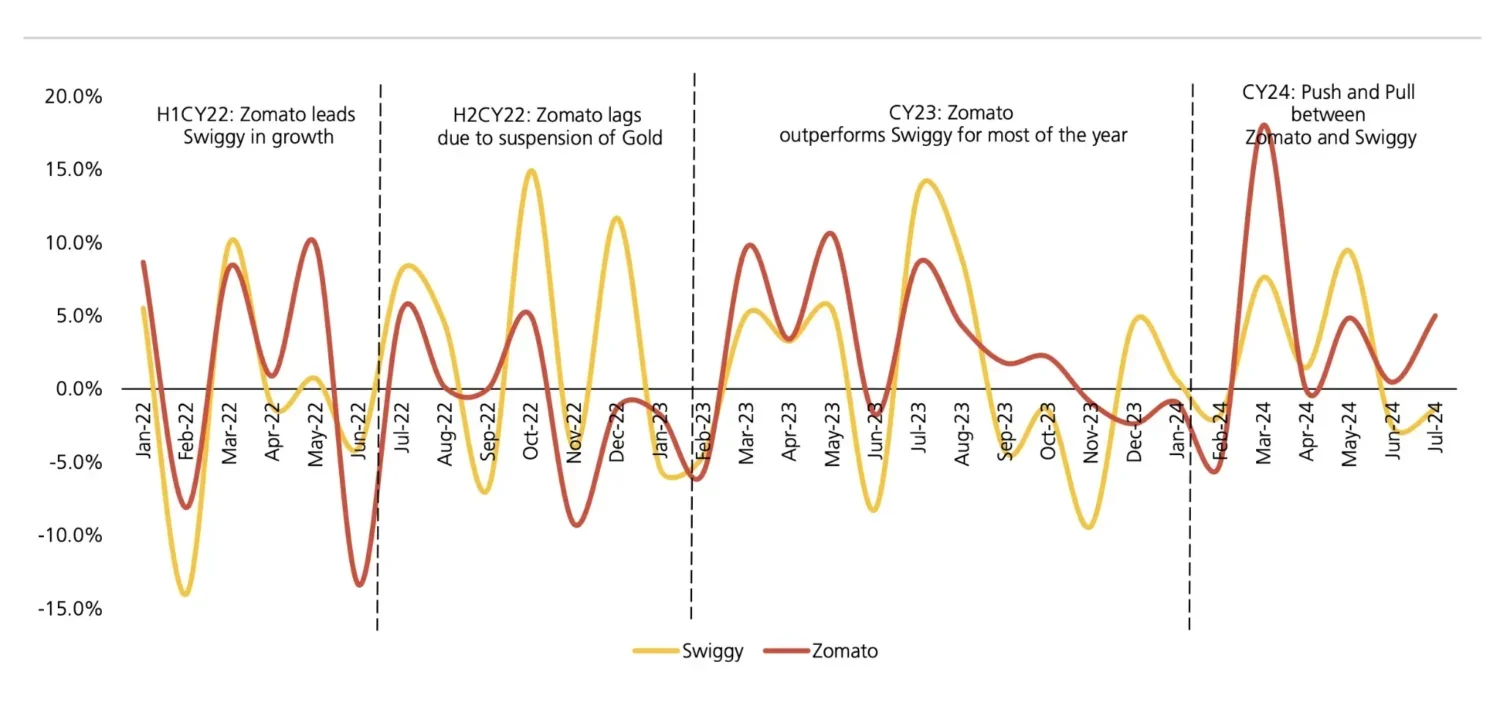

The graph provided showcases the fluctuating performance of Zomato and Swiggy from January 2022 to July 2024. It highlights the ongoing rivalry between the two companies as they vie for dominance in the food delivery sector.

2022: A Year of Divergent Paths

📈 H1CY22: Zomato Leads Swiggy in Growth

The first half of 2022 was marked by Zomato’s strong performance, outpacing Swiggy in terms of growth. Zomato’s expansion strategy, which included aggressive marketing and deeper penetration into Tier 2 and Tier 3 cities, paid off. Additionally, Zomato’s investment in its technology platform improved user experience, leading to higher customer retention and order frequency.

Key Initiatives:

- 🏙️ Expansion into smaller cities.

- 🤝 Strategic partnerships with restaurants.

- 🎁 Introduction of loyalty programs.

On the other hand, Swiggy faced challenges, including operational inefficiencies and higher customer acquisition costs. Despite these hurdles, Swiggy managed to maintain a significant market presence, thanks to its focus on customer service and delivery speed. 🚚💨

📉 H2CY22: Zomato Lags Due to Suspension of Gold

The latter half of 2022 saw a shift in momentum. Zomato’s decision to suspend its Zomato Gold program, a popular subscription service offering discounts, led to a slowdown in its growth. The suspension was part of Zomato’s strategy to streamline operations and focus on profitability, but it resulted in customer dissatisfaction and a dip in order volumes.

Meanwhile, Swiggy capitalized on Zomato’s misstep by launching new features and offers, regaining some of the lost ground. Swiggy’s continued investment in its Instamart service, which focuses on grocery delivery, also began to pay off, contributing to overall growth. 🛒📦

2023: Zomato Takes the Lead

📈CY23: Zomato Outperforms Swiggy for Most of the Year

In 2023, Zomato bounced back, outperforming Swiggy for the majority of the year. This resurgence can be attributed to several strategic decisions:

✨ Reintroduction of Zomato Gold: Zomato reintroduced its Gold program with enhanced benefits, which was well-received by customers, driving higher engagement and order frequency.

💼 Focus on Profitability: Zomato’s efforts to improve unit economics, including optimizing delivery costs and reducing discounts, began to show results, leading to improved financial performance.

📦 Expansion of Offerings: Zomato expanded its offerings beyond food delivery, including initiatives like intercity food delivery and a foray into the dining-out segment, which diversified its revenue streams.

On the other hand, Swiggy faced a challenging year. Despite strong growth in its Instamart service 🛒, the core food delivery business struggled due to increased competition and rising operational costs. Swiggy’s heavy reliance on discounts and promotions also weighed on its profitability.

2024: The Push and Pull Between Zomato and Swiggy

⚔️CY24: A Year of Intense Competition

As of mid-2024, the battle between Zomato and Swiggy remains intense, with both companies experiencing fluctuating performance. The graph indicates a “push and pull” dynamic, where each company takes turns outperforming the other. ⚖️

Zomato’s Strategy: Zomato has focused on enhancing customer loyalty through personalized offers and an improved user experience. The company is also investing heavily in technology, such as AI-driven recommendations 🤖, to increase order value and frequency.

Swiggy’s Countermeasures: Swiggy has responded by doubling down on its Instamart service 🛒, aiming to dominate the quick commerce space. Swiggy’s foray into delivering non-food items has also helped it maintain customer engagement across multiple verticals.

Both companies are also exploring new markets 🌍 and experimenting with alternative revenue models, such as cloud kitchens 🍳 and subscription services, to sustain growth in an increasingly competitive environment.

Comparative Analysis: Zomato vs. Swiggy

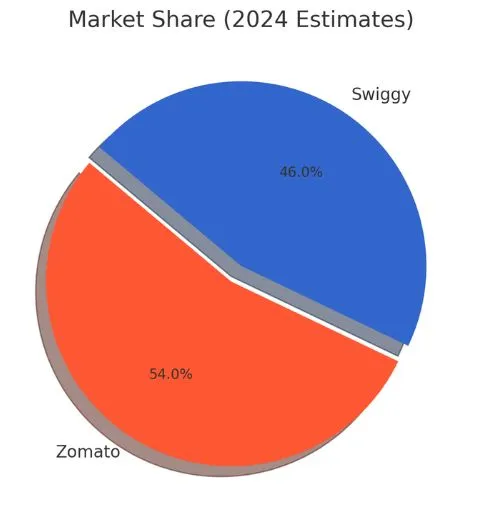

Market Share and Revenue Growth

As of the latest reports, Zomato holds a slight edge over Swiggy in terms of market share, largely due to its diverse offerings and strategic initiatives. However, Swiggy remains a formidable competitor, with a stronghold in grocery delivery through Instamart.

Zomato: 54% Swiggy: 46%

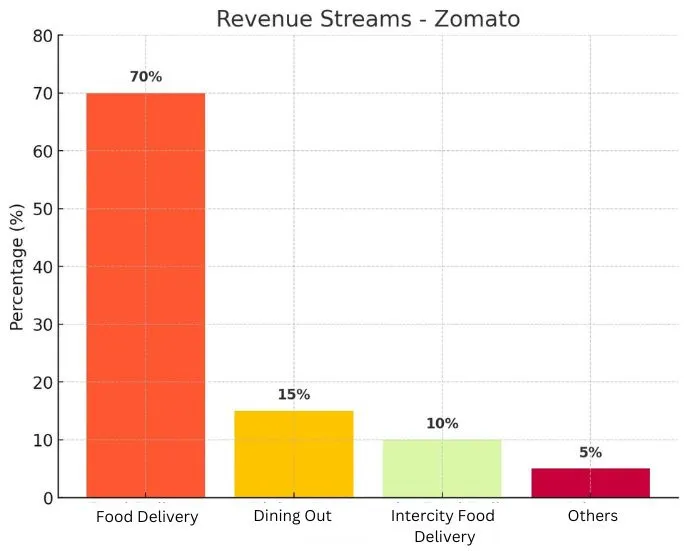

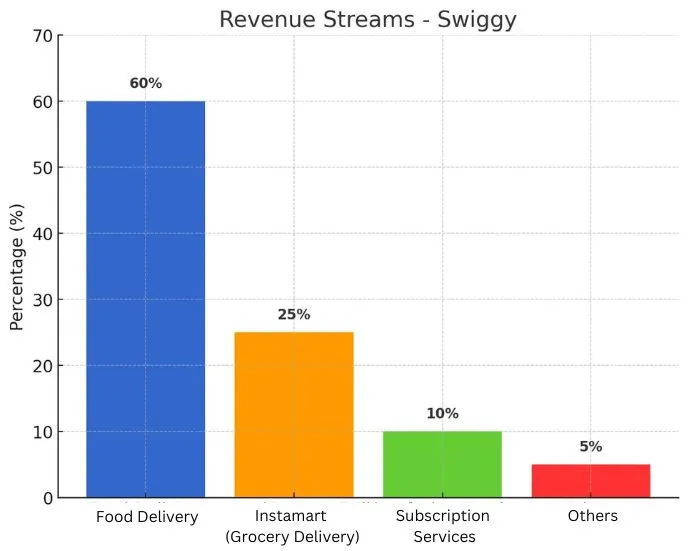

Revenue Streams

Profitability and Cost Structures

Profitability💹remains a significant challenge for both Zomato and Swiggy. However, Zomato’s focus on improving unit economics has led to better margins in recent quarters.

Zomato’s Strategy:

- 🔻 Reduction in discounting.

- ⚙️ Optimization of delivery costs through technology.

- 🍽️ Increased focus on high-margin offerings like intercity food delivery.

Swiggy’s Strategy:

- 🚀 Expansion into high-margin quick commerce (Instamart).

- 🔧 Reduction of operational inefficiencies.

- 📦 Experimentation with subscription models to ensure steady revenue streams.

Customer Experience and Loyalty Programs

Customer experience and loyalty programs play a crucial role in retaining users in the highly competitive food delivery market.

Zomato Gold🥇: Reintroduced in 2023, Zomato Gold offers exclusive discounts and benefits, making it a key driver of customer retention.

Swiggy Super💎: Swiggy’s subscription service offers free deliveries, discounts, and priority customer service, which has helped maintain customer loyalty.

Future Trends and Projections

🤖 AI and Machine Learning

Both Zomato and Swiggy are increasingly leveraging AI and machine learning to enhance customer experience, optimize delivery routes, and improve order recommendations. This technology is expected to play a pivotal role in shaping the future of food delivery.

🛒 Quick Commerce and Beyond

Swiggy’s success with Instamart has highlighted the potential of quick commerce. Both companies are likely to expand their offerings beyond food delivery, with a focus on grocery delivery, convenience items, and even pharmaceuticals. 💊

🌍 Sustainability Initiatives

As environmental concerns grow, Zomato and Swiggy are exploring ways to reduce their carbon footprint. Initiatives like electric vehicle (EV) adoption for deliveries, sustainable packaging, and carbon offset programs are expected to become more prominent in their operations. 🚴♂️

🤝 Consolidation and Acquisitions

Given the intense competition, the Indian food delivery market could see consolidation in the coming years. Strategic acquisitions, particularly in technology and quick commerce, could play a significant role in shaping the competitive landscape.

Conclusion: Zomato vs. Swiggy

The rivalry between Zomato and Swiggy has been a defining feature of the Indian food delivery market from 2022 to 2024. Both companies have demonstrated resilience, innovation, and a keen understanding of market dynamics. 🔄 As they continue to adapt to the changing landscape, it will be fascinating to see how they navigate the challenges and opportunities that lie ahead.

While Zomato has managed to gain a slight edge in recent years, the competition remains fierce, and Swiggy’s diversified approach ensures that it remains a strong contender. The future of the Indian food delivery market is undoubtedly exciting, with Zomato and Swiggy leading the charge in shaping the way Indians order food.