Managing personal finances effectively is crucial for long-term financial stability and growth. Understanding and applying key financial principles can help you make smarter decisions, plan for the future, and achieve your financial goals. Here are 11 essential personal finance rules every person should know:

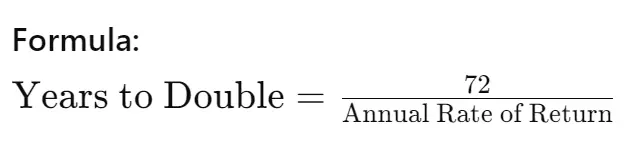

1. Rule of 72 (Double Your Money)

The Rule of 72 is a simple way to estimate how long it will take for an investment to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, you get an approximation of the number of years it will take for your initial investment to grow to twice its size.

For example, if you have an investment that earns 6% annually, it will take approximately 12 years to double (72 ÷ 6 = 12).

2. Rule of 70 (Inflation Adjustment)

Similar to the Rule of 72, the Rule of 70 helps you understand how long it will take for the value of money to halve due to inflation. By dividing 70 by the annual inflation rate, you can estimate how many years it will take for your purchasing power to decrease by half.

Formula: Years to Halve=70Annual Inflation Rate\text{Years to Halve} = \frac{70}{\text{Annual Inflation Rate}}Years to Halve=Annual Inflation Rate70

For instance, with an annual inflation rate of 2%, it would take about 35 years for the value of money to halve (70 ÷ 2 = 35).

3. 4% Withdrawal Rule

The 4% Withdrawal Rule is a guideline for retirees on how much they can withdraw from their retirement savings each year without running out of money. The idea is that by withdrawing 4% of your retirement portfolio annually, adjusted for inflation, you can sustainably fund your retirement for at least 30 years.

Application: If you have a retirement portfolio of $1,000,000, you can withdraw $40,000 in the first year. Each subsequent year, adjust the amount by the inflation rate to maintain purchasing power.

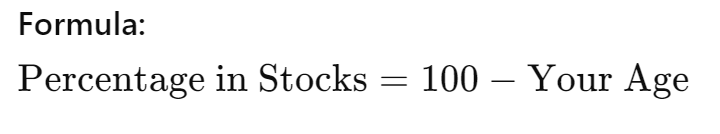

4. 100 Minus Age Rule

The 100 Minus Age Rule is a guideline for asset allocation, specifically how much of your portfolio should be invested in stocks versus bonds. Subtract your age from 100 to determine the percentage of your portfolio that should be in stocks, with the remainder in bonds.

For a 30-year-old, this means 70% in stocks and 30% in bonds (100 – 30 = 70).

5. 10, 5, 3 Rule

The 10, 5, 3 Rule is a guideline for expected returns on different types of investments. Historically, stocks have returned around 10% per year, bonds around 5% per year, and savings accounts or other cash investments around 3% per year.

Expectations:

Stocks: 10% return

Bonds: 5% return

Savings accounts: 3% return

These are historical averages and actual returns can vary.

6. 50-30-20 Rule

The 50-30-20 Rule is a simple budgeting guideline. It suggests allocating 50% of your income to needs (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

Breakdown:

Needs: 50%

Wants: 30%

Savings/Debt Repayment: 20%

This rule helps ensure that you live within your means while also saving for the future.

7. 3X Emergency Rule

The 3X Emergency Rule advises having an emergency fund that covers at least three to six months’ worth of living expenses. This fund should be easily accessible and kept in a liquid form, such as a savings account, to cover unexpected expenses like medical bills, car repairs, or job loss.

If your monthly expenses are $2,000, aim for an emergency fund of $6,000 to $12,000.

8. 40% EMI Rule

The 40% EMI Rule suggests that your Equated Monthly Installments (EMIs) or debt payments should not exceed 40% of your monthly income. This ensures you have enough income left for other expenses and savings.

If your monthly income is $5,000, your total EMI should not exceed $2,000.

9. Life Insurance Rule

A common rule of thumb for life insurance coverage is to have a policy that is 10 to 15 times your annual income. This ensures that your dependents are financially secure in the event of your untimely death.

If your annual income is $50,000, aim for life insurance coverage of $500,000 to $750,000.

10. Rule of 144

The Rule of 144 is a lesser-known rule that involves understanding the growth of investments over a long period. It states that an investment that doubles every 12 years will grow by a factor of 144 over 72 years. This is useful for long-term financial planning, illustrating the power of compound interest.

For an investment with an annual return of 6%, it will double approximately every 12 years.

11. Revolving Credit Formula: (1 + i%)^12 - 1

The Revolving Credit Formula helps calculate the effective annual interest rate for credit card debt and other revolving credit lines, taking into account the effect of compounding monthly interest.

Conclusion : 11 Personal Finance Rules Every Person Should Know

Understanding and applying these 11 personal finance rules can significantly improve your financial health and help you achieve your long-term goals. From budgeting and saving to investing and managing debt, these principles provide a solid foundation for sound financial management.