Table Of Contents

- Introduction: The Hidden Battle Against Online Fraud

- Understanding the Customer Journey in Fraud Prevention

- The Mechanics of Embedding Systems in Fraud Detection

- Benefits of Integrating Customer Journey Analytics

- Practical Strategies for Implementing Real-Time Fraud Detection

- Exploring Advanced Applications and Future Trends

- FAQs

- Conclusion: Empowering Safer Online Experiences

Introduction: The Hidden Battle Against Online Fraud

Imagine logging into your favorite online store, browsing for a new couch, and suddenly realizing your account has been hijacked. Unauthorized charges rack up, personal details are exposed, and trust in the platform crumbles. This isn’t just a nightmare—it’s a reality for millions facing fraud each year. According to the Federal Trade Commission, consumers reported losing over $10 billion to fraud in 2023 alone, with online shopping scams leading the charge. But what if businesses could predict and prevent these threats by deeply understanding how customers navigate their sites? Enter the customer journey embedding system for fraud detection—a game-changing approach that’s transforming how companies like Wayfair combat scams.

In this blog, we’ll dive into this innovative technology, drawing from real-world implementations like Wayfair’s Melange system. We’ll explore its mechanics, benefits, and practical applications, all while weaving in insights on fraud and scam detection with customer journey analytics. Whether you’re an e-commerce leader, a data scientist, or just curious about staying safe online, you’ll find actionable strategies here to bolster security without sacrificing user experience.

Understanding the Customer Journey in Fraud Prevention

The customer journey isn’t just about clicks and carts—it’s a roadmap of behaviors that can reveal honest shoppers from sneaky fraudsters. Traditional fraud detection often relies on static checks like IP addresses or transaction amounts, but these miss the subtle patterns in how users interact over time. That’s where customer journey mapping for fraud prevention comes in. By charting every step—from homepage views to checkout—it uncovers anomalies that signal trouble.

Think of it like a detective piecing together clues. A legitimate user might browse categories leisurely, read reviews, and add items gradually. A fraudster, however, could rush through pages, use unusual search terms, or exhibit erratic session jumps. Embedding techniques for fraud detection take this a step further by converting these journeys into mathematical representations, or vectors, in a high-dimensional space. This allows machines to spot similarities and differences at scale.

Wayfair’s approach exemplifies this. They developed Melange, a system that analyzes session histories to generate embeddings. Instead of manual stats like “average visits in 7 days,” Melange uses sequence modeling to automatically extract complex patterns. This shift from rigid features to dynamic embeddings has led to up to 18% improvements in fraud model performance, as measured by Precision-Recall curves. It’s a testament to how behavioral analytics in fraud prevention can outpace evolving threats.

The Mechanics of Embedding Systems in Fraud Detection

At its core, a customer journey embedding system for fraud detection is about turning raw data into smart insights. Embeddings are vector representations that capture the essence of user interactions. Similar journeys cluster together in this space, making it easier to flag outliers.

Wayfair’s Melange relies on self-supervised representation learning, a clever method that doesn’t need labeled data. It starts with a pretext task—predicting the next page in a user’s session based on past ones. For instance, after searching for “TV stands,” the model anticipates a product detail view or add-to-cart action. This trains the system to understand normal flows without human input.

Once trained, the embedding layers are extracted and used for inference. Wayfair runs this hourly on Google Cloud’s Vertex Pipeline: collecting recent sessions, generating session embeddings, and aggregating them into a single customer vector. These vectors then feed into downstream machine learning fraud detection systems, combining with other features like purchase history.

Why does this work so well? Embeddings handle time-series data’s complexities, like dependencies between actions. Unlike traditional methods that might overlook a fraudster mimicking patterns briefly, embeddings reveal deeper inconsistencies. Industry trends back this up—Gartner’s 2024 report predicts that by 2026, 60% of enterprises will use AI-based fraud detection incorporating behavioral analytics, up from 25% today.engageware.com

Benefits of Integrating Customer Journey Analytics

Adopting fraud and scam detection with customer journey analytics isn’t just about catching bad actors—it’s about building trust and efficiency. One major perk is proactive prevention. By monitoring journeys in near-real-time, systems can intervene before damage occurs, like flagging a suspicious cart addition and prompting extra verification.

Take the stats: A 2023 study by Juniper Research estimates that e-commerce fraud will cost merchants $48 billion annually by 2025. But with embedding techniques, companies reduce false positives—those annoying times when legitimate transactions get blocked. Wayfair saw significant lifts in model accuracy, meaning fewer good customers frustrated and more fraudsters stopped.

Another advantage is scalability. Manual feature engineering is labor-intensive and prone to bias, but self-supervised systems learn autonomously. This democratizes advanced fraud prevention for smaller businesses too. Plus, it adapts to new tactics; as scammers evolve, the model retrains on fresh data, staying ahead.

Real-world case: Beyond Wayfair, banks like JPMorgan Chase use similar embeddings in their apps to detect unusual login sequences, cutting scam losses by 20-30%. For e-commerce, this means embedding customer journey data with machine learning for fraud prevention can slash chargebacks and boost revenue.JPMorgan.com

Practical Strategies for Implementing Real-Time Fraud Detection

Ready to put this into action? Real-time fraud detection strategies powered by embeddings start with data collection. Track session events meticulously—page views, clicks, time spent—using tools like Google Analytics or custom trackers.

Next, choose your model. Open-source options like TensorFlow or PyTorch support building embedding layers. For pretext tasks, experiment with sequence prediction, as Wayfair did. Train on historical data, then deploy via cloud pipelines for hourly updates.

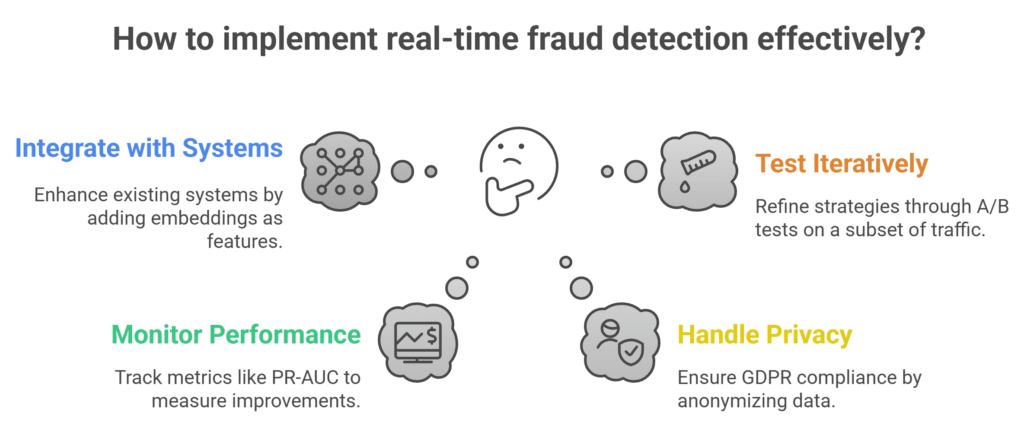

Tips for success:

- Integrate with existing systems: Feed embeddings into your current machine learning fraud detection systems as additional features.

- Monitor performance: Use metrics like PR-AUC to measure gains, aiming for 10-20% improvements.

- Handle privacy: Comply with GDPR by anonymizing data and focusing on patterns, not individuals.

- Test iteratively: Start with A/B tests on a subset of traffic to refine without risking the whole platform.

Challenges? Data volume can be overwhelming, so use efficient aggregation like averaging session embeddings. Also, ensure diversity in training data to avoid biases against certain user groups.

Exploring Advanced Applications and Future Trends

Embeddings aren’t limited to fraud. Wayfair hints at expanding Melange to churn prediction, segmentation, and personalization—imagine recommending products based on journey patterns. In financial services, embedding techniques prove effective for scam detection, analyzing transaction sequences to spot money laundering.

Looking ahead, trends point to transformers and graph neural networks for even richer representations. Contrastive learning could push similar legitimate journeys closer while distancing fraud ones. With 5G enabling faster data, near-real-time embeddings will become standard, reducing detection lags from minutes to seconds.artsmart.ai

Industry patterns show a shift: McKinsey reports that AI-based fraud detection could save banks $1 trillion by 2030. For e-commerce, combining customer journey data and machine learning for fraud prevention will be key to staying competitive.

What is a Customer Journey Embedding System in Fraud Detection?

It’s a machine learning setup that converts user navigation paths into vector embeddings, highlighting patterns for spotting fraud. Unlike basic rules, it uses self-supervision to learn without labels, as seen in Wayfair’s Melange.

What Role Does Customer Journey Analytics Play in Identifying Scams?

Customer journey analytics examines interaction sequences to detect deviations, like abrupt checkouts. This aids in scam identification by revealing behavioral red flags early.

What Are the Benefits of Mapping the Customer Journey for Fraud Prevention?

Mapping pinpoints vulnerabilities, reduces losses (up to 30% in some cases), and enhances user trust. It also cuts false positives, improving conversion rates.

How Do Customer Journey Analytics Improve Fraud and Scam Detection?

By integrating time-series data, analytics predict anomalies in real-time, boosting detection accuracy. Wayfair’s system, for example, aggregates sessions for holistic views.

How Can Embedding Systems Detect Suspicious Customer Behavior?

Embeddings cluster normal behaviors; outliers signal suspicion. They capture nuances like session pacing, far beyond simple counts.

Can Integrating Customer Journey Analytics Reduce Fraud Cases?

Absolutely—studies show 20-40% reductions by catching issues proactively, as in banking and retail.

Should Businesses Use Customer Behavior Data to Improve Fraud Security?

Yes, it’s essential for modern threats. Ethical use builds stronger defenses without invading privacy.

Are Embedding Techniques Effective for Scam Detection in Financial Services?

Proven effective, with firms like Chase reporting lower losses through sequence analysis.

FAQs

Conclusion:

Empowering Safer Online Experiences

The customer journey embedding system for fraud detection represents a leap forward in securing digital spaces. From Wayfair’s Melange boosting model performance to broader industry adoption, it’s clear this tech addresses fraud’s complexities head-on. By embracing behavioral analytics in fraud prevention and machine learning fraud detection systems, businesses can protect users while fostering growth.

Ready to implement? Start small—map your journeys, experiment with embeddings, and watch threats diminish. In a world where scams evolve daily, staying vigilant through innovative tools isn’t optional—it’s essential for thriving.Visit:CareerSwami for More.