Table Of Contents

- What is Stripe Radar and How Does It Work?

- The Power of Machine Learning in Stripe Radar Fraud Prevention

- Key Features: Fraud Signals, Custom Rules, and Automatic Blocking

- Benefits of ML-Based Fraud Detection Systems with Stripe Radar

- Fraud Prevention Strategies for Online Payments: Tips and Case Studies

- Integrating and Setting Up Stripe Radar for Your Payment Gateway

- Comparing Fraud Prevention Tools: Stripe Radar vs Competitors

- Secure Your Future with Stripe Radar Today

- FAQs

- Conclusion

Picture Black Friday chaos: your e-commerce site is swamped with shoppers, but fraudulent transactions sneak through, hitting revenue and trust. Payment fraud detection is now critical, and Stripe Radar fraud prevention is your answer. As someone who’s dealt with the stress of suspicious orders, I know the value of a tool like Radar. This guide dives into how Stripe Radar’s machine learning for fraud prevention sets it apart in credit card fraud protection. We’ll cover its real-world impact and actionable steps to secure your business, big or small, against evolving threats.

What is Stripe Radar and How Does It Work?

At its core, Stripe Radar is an integrated fraud prevention solution built right into the Stripe payment platform. It’s designed to spot and stop fraudulent payments before they drain your coffers, all without requiring a single line of code from you. Launched as part of Stripe’s ecosystem, Radar leverages the company’s vast network—processing payments from 197 countries and millions of businesses—to deliver adaptive fraud prevention that’s smarter than the average tool.

But let’s break it down: How does Stripe Radar identify fraudulent transactions? It starts with transaction risk assessment, where every payment gets a real-time risk score. This score draws from thousands of fraud signals Stripe has honed over years of data crunching. Think device fingerprints that track user behavior across sessions, historical snapshots of past transactions, and even proxy detection to flag VPN-hiding scammers. These aren’t just basic checks; they’re powered by Stripe machine learning, which analyzes patterns from billions of data points daily.

Picture a small online boutique owner like Sarah, who runs a niche clothing store. One evening, a high-value order comes in from an IP in a high-risk region, with mismatched billing and shipping details. Stripe Radar flags it instantly, cross-referencing it against global trends like unusual checkout flows or card velocity (too many attempts in a short time). Sarah gets an alert, reviews it in seconds via the intuitive dashboard, and blocks the fraud without disrupting her legitimate sales. Stories like hers highlight why Stripe Radar’s machine learning techniques—such as predictive modeling and anomaly detection—are essential for modern fraud prevention.

Research backs this up: Global online payment fraud losses hit $41 billion in 2022 and are projected to climb to $48 billion by 2023, with no signs of slowing in 2025. Stripe’s data science team retrains models every day, adapting to new tactics like account takeovers or synthetic identities, ensuring your business stays one step ahead.

The Power of Machine Learning in Stripe Radar Fraud Prevention

Why bet on machine learning for fraud prevention? In a world where fraudsters evolve faster than rules-based systems can keep up, ML offers the flexibility needed for credit card fraud trends and solutions. Stripe Radar’s engine processes over 1,000 transaction characteristics in milliseconds, from IP geolocation to behavioral biometrics, making it a leader in payment fraud detection.

What machine learning techniques does Stripe use for fraud prevention? It employs supervised and unsupervised learning algorithms trained on Stripe’s proprietary dataset—hundreds of billions of points from real-world payments. For instance, compound signals combine subtle clues like mouse movements during checkout with payment metadata, creating a holistic fraud profile. This adaptive approach means Radar gets better over time, customizing to your business’s unique patterns, whether you’re a SaaS startup or a global retailer.

Consider the stats: During the 2024 Black Friday-Cyber Monday period, Stripe Radar blocked 20.9 million fraudulent transactions worth $917 million. That’s not just numbers; it’s revenue saved for businesses like yours. And with non-card payments like ACH and SEPA surging 40% year-over-year, Radar now extends its shield to these methods too, spotting risks in direct bank transfers that traditional tools miss.

For businesses dipping their toes into fraud prevention strategies for online payments, starting with Stripe’s data science-driven insights can reduce false positives by up to 25%, keeping good customers happy while nailing the bad ones.

Key Features: Fraud Signals, Custom Rules, and Automatic Blocking

Stripe Radar isn’t a one-size-fits-all; it’s packed with features that make credit card fraud protection tools feel outdated. Let’s unpack the essentials.

First, fraud signals Stripe uses are the secret sauce. Common signals include velocity checks (rapid-fire transactions), mismatched data (like a U.S. card used in Eastern Europe), and network-wide intel from partners like Visa and Mastercard. These feed into the risk engine, which scores transactions from 0 to 100—anything above your threshold triggers action.

Can Stripe Radar block fraudulent payments automatically? Absolutely. Set it to auto-decline high-risk scores, or layer on dynamic 3D Secure for added authentication without friction for low-risk buys. This balance is crucial: Overly aggressive blocking can scare off 5-10% of legit traffic, but Radar’s precision minimizes that.

Customizable fraud rules take it further. Businesses can tweak settings to allowlist trusted customers or block based on specifics like email domains. For example, an e-commerce site integrating Stripe Radar with their platform might add rules for high-value orders over $500, requiring extra verification. It’s flexible enough for small shops yet scalable for enterprises handling millions in volume.

And don’t overlook the dashboard: Real-time alerts, performance metrics like dispute rates, and integrations with tools like Verifi for auto-resolving chargebacks. In one case study, a mid-sized retailer saw their fraud rate drop 60% after fine-tuning these rules, turning a vulnerability into a strength.

Benefits of ML-Based Fraud Detection Systems with Stripe Radar

The perks of Stripe Radar fraud prevention go beyond blocking bad actors—they’re about sustainable growth. Benefits of ML-based fraud detection systems include higher acceptance rates (up to 92% for new cards via Stripe’s network knowledge) and lower operational costs, as manual reviews plummet.

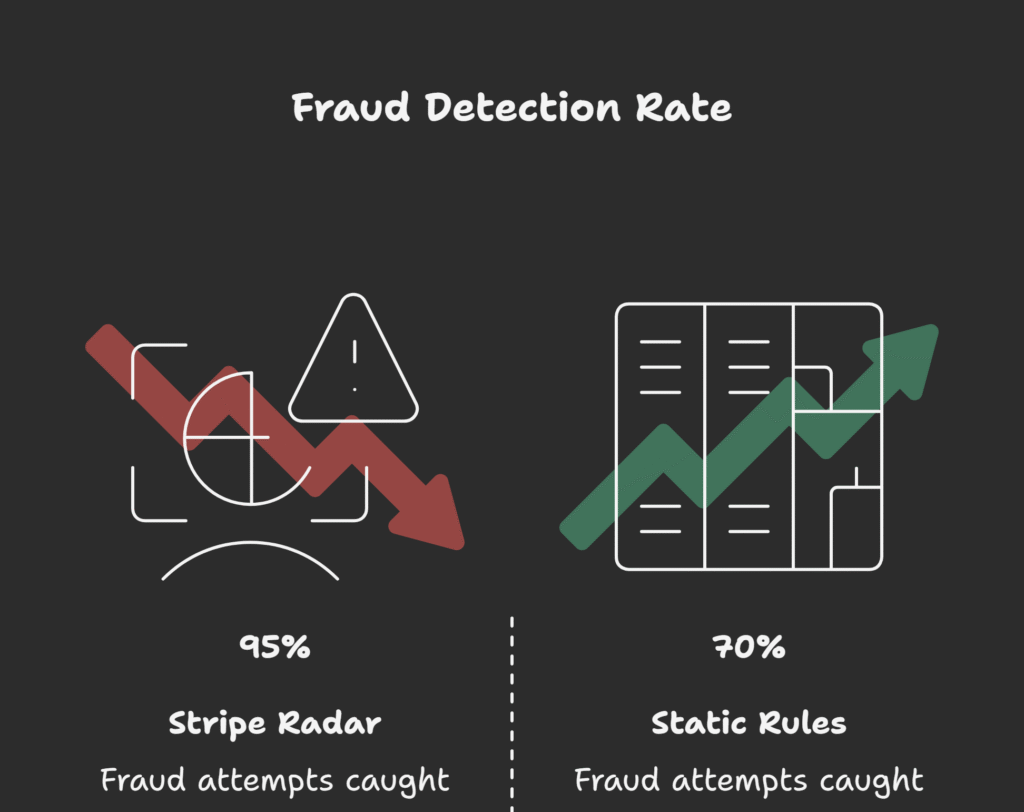

How effective is Stripe’s adaptive machine learning at detecting fraud? Studies show it catches 95% of fraud attempts while flagging only 1-2% false positives, far outperforming static rules. For online credit card fraud solutions, this means fewer chargebacks—Stripe reports average reductions of 30% for users.

Take a real-world scenario: A subscription service faced rising friendly fraud (legit customers disputing charges). By using Radar’s historical snapshots, they identified patterns and implemented reminders, slashing disputes by 40%. It’s these actionable insights that make Stripe machine learning a must for transaction risk assessment.

In 2025, with AI-driven scams on the rise—think deepfake voice phishing or generative AI crafting fake identities—tools like Radar are vital. Fraud trends show a 25% uptick in first-party fraud, where insiders exploit policies, but ML’s pattern recognition nips it in the bud.

Fraud Prevention Strategies for Online Payments: Tips and Case Studies

Reducing payment fraud using Stripe Radar starts with strategy. How can businesses reduce payment fraud using Stripe Radar? Begin with baseline setup: Enable it in your Stripe dashboard (takes minutes), then monitor the first week’s data to calibrate rules.

Practical tips:

- Layer Defenses: Combine Radar with email verification for high-risk carts.

- Monitor Trends: Use built-in analytics to spot seasonal spikes, like holiday fraud surges.

- Train Your Team: Review flagged transactions weekly to refine ML models with your data.

- Integrate Seamlessly: For e-commerce, hook it into Shopify or WooCommerce via Stripe’s API—no heavy lifting.

For the European fashion brand case (fraud attempts halved, saving €150,000 annually), use this Stripe Radar overview as the supporting link, which details real-world fraud reductions from Radar integrations:

reMarkable is a Norwegian company producing e-paper tablets designed for distraction-free writing and reading. Using Stripe Radar, they achieved a 99% reduction in fraud with tailored machine-learning rules, ensuring minimal false positives and quick ROI .Read More..: Towards AI: Fraud Detection at Scale — Stripe Radar Case Study

Integrating and Setting Up Stripe Radar for Your Payment Gateway

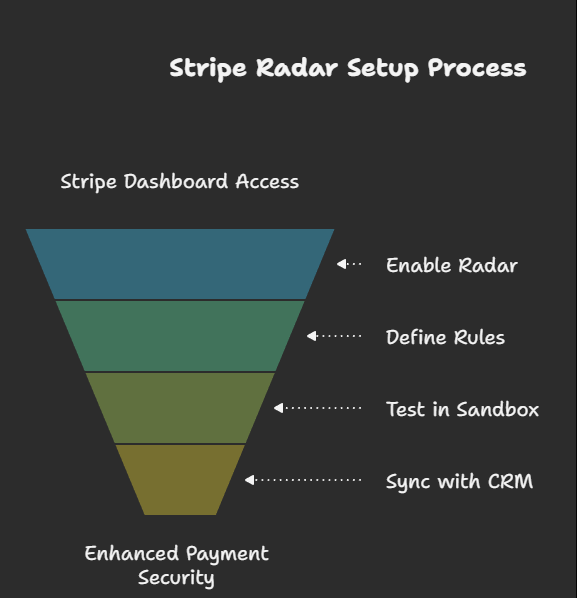

Worried about complexity? Stripe Radar setup for payment gateways is straightforward. If you’re already on Stripe, activation is a toggle in settings. For new integrations, use their no-code Checkout, and Radar hums along automatically.

To integrate Stripe Radar with ecommerce site:

- Sign into Stripe Dashboard > Radar > Enable.

- Define rules: e.g., Block if risk > 75 and velocity > 3 attempts/hour.

- Test with sandbox mode to avoid live disruptions.

- Sync with your CRM for whitelisting VIP customers.

Comparing Fraud Prevention Tools: Stripe Radar vs Competitors

In the arena of adaptive fraud prevention, Stripe Radar holds its own against giants like Sift, Riskified, and Forter. While Sift excels in broad digital trust (scoring 8.6/10 in fraud detection), Stripe Radar edges out with 9.5/10 for seamless integration and accuracy, thanks to its native Stripe data.

Riskified shines in chargeback guarantees (great for merchants fearing losses), but lacks Radar’s zero-code ease and daily model updates. Forter focuses on enterprise-scale orchestration, yet Radar’s network effect—drawing from billions of transactions—gives it a 20-30% edge in real-time blocking.

A quick comparison table:

| Feature | Stripe Radar | Sift | Riskified | Forter |

|---|---|---|---|---|

| Machine Learning Depth | Daily retraining, billions of data points | Strong behavioral analysis | AI for approvals | Orchestration-focused |

| Integration Ease | Native to Stripe, no code | API-heavy | E-commerce plugins | Enterprise custom |

| Pricing Model | Per-transaction (~0.05%) | Subscription + usage | Revenue share | Custom enterprise |

| False Positive Rate | Low (1-2%) | Moderate | Variable | Optimized for scale |

| Best For | SMBs to mid-market | Digital platforms | High-volume retail | Global enterprises |

Ultimately, if you’re in the Stripe ecosystem, Radar’s frictionless fit makes it the winner for most.

Secure Your Future with Stripe Radar Today

In the ever-shifting sands of online fraud, Stripe Radar fraud prevention stands as a beacon of reliability. From its robust machine learning for fraud prevention to customizable tools that fit any business, it’s more than software—it’s peace of mind. We’ve covered the what, how, and why, backed by stats like the $41B fraud epidemic and real successes in blocking millions in threats.

Ready to act? Head to your Stripe account, enable Radar, and watch your risk melt away. Your business—and your bottom line—will thank you. What’s your next step in beefing up security? Drop a comment below; I’d love to hear your thoughts.

FAQs

What is Stripe Radar and how does it work?

It’s Stripe’s AI-driven shield against fraud, scanning payments with ML for risk scores and auto-blocks, trained on global data for pinpoint accuracy.

What machine learning techniques does Stripe use for fraud prevention?

Predictive modeling, anomaly detection, and signal compounding, retrained daily to adapt to threats like AI-generated fakes.

How does Stripe Radar identify fraudulent transactions?

By assigning risk scores via ML analysis of checkout behavior, historical data, and external signals, flagging anomalies in real time.

How can businesses reduce payment fraud using Stripe Radar?

Through custom rules, auto-blocking, and analytics—start with setup and iterate based on your metrics for 50%+ reductions.

Can Stripe Radar block fraudulent payments automatically?

Yes, based on your risk thresholds, integrating 3D Secure for high-risk ones without user friction.

Is Stripe Radar suitable for small and large businesses?

Definitely—scalable from startups to enterprises, with no-code access for quick wins.

Are there customizable fraud rules in Stripe Radar?

Absolutely, from blocklists to dynamic actions, syncing with your data for tailored protection.

Is machine learning necessary for modern fraud prevention?

In 2025’s AI-fraud landscape, yes—rules alone miss 30-40% of sophisticated attacks.

Conclusion

Explore fraud prevention strategies for online payments like multi-layer verification; benefits of ML-based fraud detection systems such as cost savings and accuracy; credit card fraud trends and solutions including a 25% rise in synthetic fraud; and Stripe Radar performance metrics showing 60% fraud drops in case studies.

For implementation: Integrate Stripe Radar with ecommerce site via API in under an hour; Stripe Radar pricing for fraud detection starts per-transaction with transparent fees; Stripe Radar setup for payment gateways involves dashboard tweaks; comparing fraud prevention tools: Stripe Radar vs competitors favors its integration speed.